Loan servicing software for private lenders refers to a specialized platform or tool designed to help manage and automate the entire process of servicing loans, from origination through repayment, for private lending institutions or individuals who lend capital outside of traditional financial institutions.

Discover the top 10 best Loan Servicing Software For Private Lenders

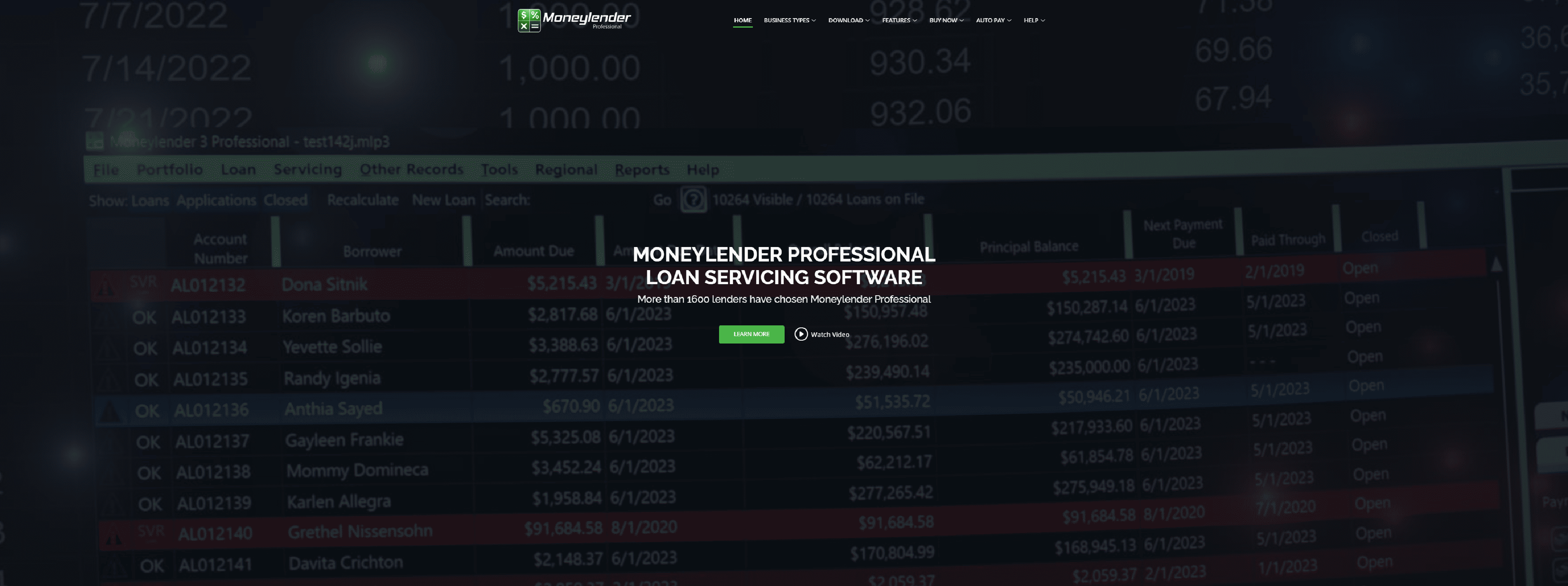

Moneylenderprofessional

Moneylenderprofessional – Reasonably priced loan servicing software gives you complete control over your loans without sacrificing anything.

- Automates all your calculations, eliminating errors

- Makes it easy to see who is paid current and who is getting behind

- Generates professional, high-quality statements, notices and letters

- The perfect solution for commercial loan software and real estate loan software

- Detailed accounting capabilities can adapt to virtually any business model

- Moneylender is powerful and can integrate as loan software for any business

- This cutting edge technology will even work for car dealers as car loan software or can replace any in-house financing software you already use

Vergentlms

Vergent’s loan servicing software for private lenders automates many of their most important tasks for greater efficiency.

- This commercial lending servicing software incorporates the most diverse range of loan products of any fintech solution

- Handle all of your loans from a single centralized module featuring the most intuitive management technology

- Our custom loan software comes with built-in features including customer portals, automated marketing funnels, ancillary products and much more

- Simplify even the most complex regulatory obligations with software built by those who know the lending industry as thoroughly as anyone

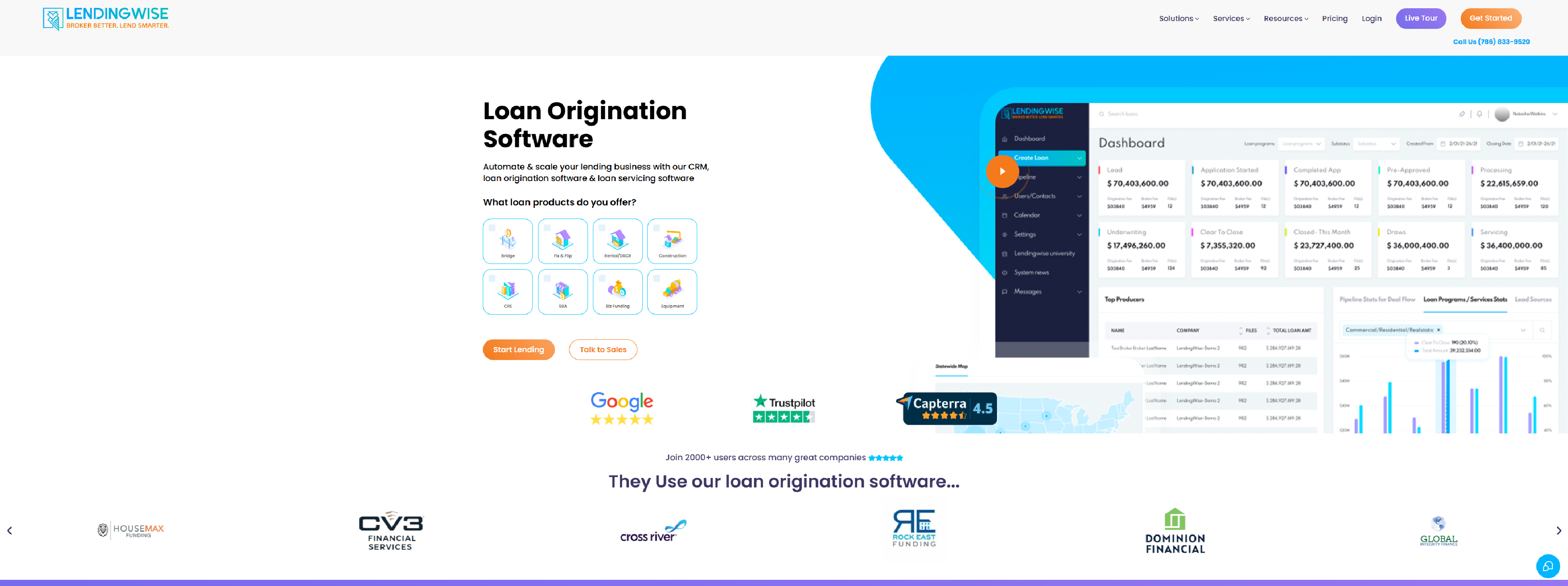

Lendingwise

Lendingwise – Automate & scale your lending business with our CRM, loan origination software & loan servicing software.

- A modern borrower experience with online, mobile friendly portals, customized workflows & paperless loan origination

- Keep your entire team, including brokers, borrowers & 3rd parties updated in real time on the loan status

- Integrate our quick & full app web forms on your site to fast track submissions & accurately collect required docs

- Our loan origination software sits 100% on AWS & is aligned with SOC 2, ISO 27001, & PCI compliance

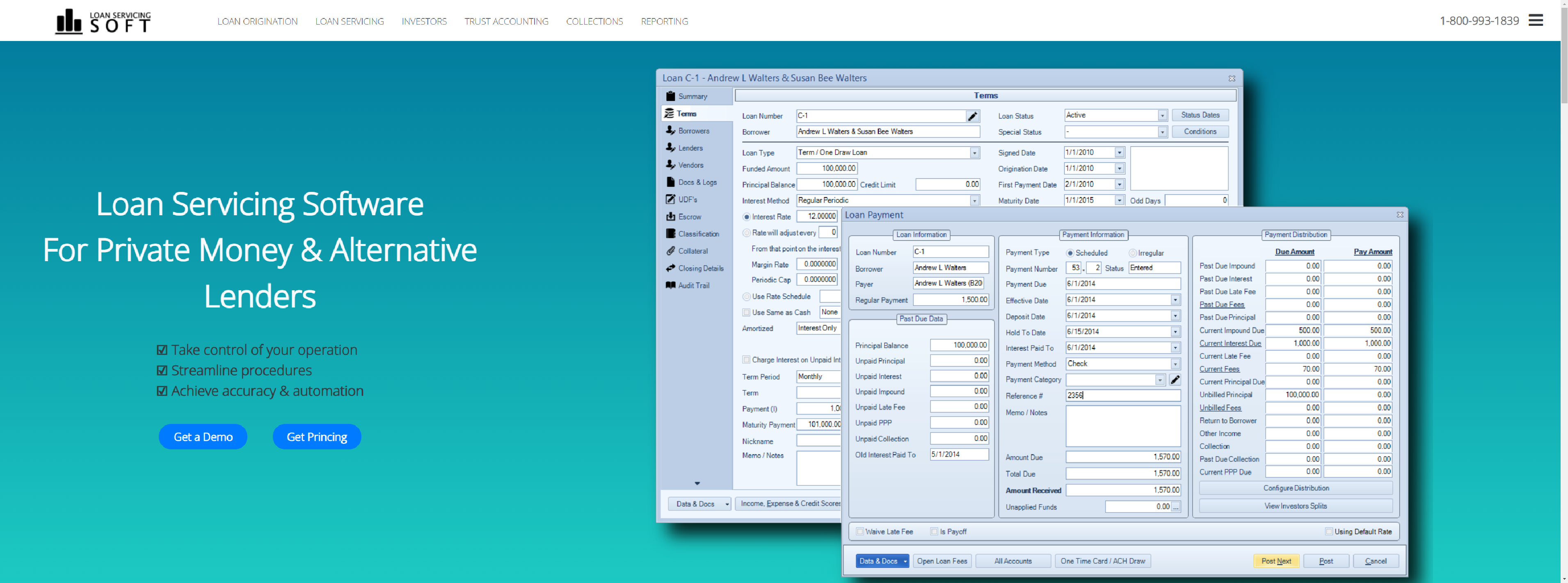

Loanservicingsoft

Loanservicingsoft – Take control and streamline your loan servicing with accuracy and automation with our loan servicing software.

- All Loan Types – Fixed, Step-Rate, ARM, Credit Lines, Multi-Draw

- Interest Methods – Simple Interest, Regular Periodic, Actual Days, Rule 78

- Investors – Multiple Investors or Funding Sources/Pools

- Private Money Features – Servicing Fees, Bought/Sold Rates

- RESPA, HMDA, CFPB compliance make LSS a perfect mortgage servicing software platform

- A perfect loan servicing software for private lenders

Mortgageautomator

Automator’s powerful features not only allow you to keep track of loan ledgers but also automate collection processes, tax payments, reserve tracking, and much more.

- Save time on documentation

- Streamline communication

- Do more with the same resources

Lendfoundry

LendFoundry offers the most advanced and best Loan Management Software(LMS)/Loan Servicing Software

- Loan Onboarding

- Accrual/Payment Processing

- Outstanding & Delay Management

- Modification and Closure

- Amortization and Transactions

- Borrower Communication

Baselinesoftware

Baseline is a modern loan origination software and servicing platform for private money lending.

- Manage all of your stakeholders in one easy-to-use tool

- Level the competitive playing field

- Eliminate workflow chaos

- Increase deal flow & velocity

Bizcore

Bizcore – An Australian made loan servicing software for private lenders. Streamline the loan process & manage your entire portfolio with a simple digital platform.

- Security

- Eliminate human error

- Easy Integration

- Improve organisation & consistency

- Data visualisation & daily reports

- Real-Time Control

Brytsoftware

Monitor all your loan processes in real-time with Bryt’s automated loan management software solution. Track relevant KPIs, make data-based loan management decisions, check your payment history, and simplify your loan processes with just a single click.

- Automated Loan Workflow

- Contact Relationship Management

- Omni-Channel Experience

- Advanced Loan Tracking

- Built-in Reporting & Documentation

- Pre-Populated Loan Notices

Themortgageoffic

Themortgageoffic flexible platform serves financial solutions companies and more.

- Escrow Administration

- Consumer Credit Reporting

- ACH Express

- Trust Accounting

- DRE Reporting

- Financial Calculator

- Lender/Borrower Portal

- Accounting Systems Integration