Financial Risk Management Software is a tool used by organizations to identify, assess, monitor, and mitigate financial risks.

Discover the top 9 financial risk management software

Seon

Seon – frictionless real-time fraud prevention and AML compliance using advanced digital footprinting, fully customisable rules and machine learning.

- Secure Your Onboarding

- Monitor User Activity In Real-Time

- Analyze AI-Driven Insights

- Consolidate Compliance In One Platform

Oracle

Oracle Financial Services Risk Management establishes a single measure of risk across your financial services organization that provides a comprehensive view of performance.

- Appraise and consolidate risk across the enterprise

- Enhance resilience using intensive stress testing

- Get a single source of truth for risk assessment

Logicmanager

Financial institutions and banks can protect against financial and reputational losses with LogicManager’s industry-leading enterprise risk management software.

- Simplify all of your financial reporting responsibilities with our powerful SOX Compliance Software

- Track all regulatory compliance requirements including FFIEC, FDIC, OCC, CFPB, Basel II, and other standards

- Operationalize your cybersecurity efforts to prevent breaches with our intuitive IT Security & Governance solution

- Identify the most critical risks in every part of your organization and allocate resources effectively with pre-built self-assessments

360factors

360factors has integrated AI in financial services compliance and risk management solutions, offering a streamlined approach to compliance and risk management.

- Automates repetitive tasks such as data collection, analysis, and reporting

- Streamline workflows across different departments and functions within your financial institution

- Ensure real-time monitoring of regulatory changes, compliance status, and risk indicators, receiving alerts and notifications for potential issues or violations to address them promptly

- Identify and assess various types of risks more accurately. Prioritize risks based on severity and likelihood, facilitating better decision-making and resource allocation

Riskonnect

Riskonnect risk management software helps financial services organizations manage risk, protect private information, and comply with strict regulations.

- Everything you need to identify, manage, and mitigate risk is all in one, easily accessible place

- Routine processes are streamlined and automated so you can spend your time where it matters most

- Riskonnect gives you the intelligence to identify and respond to evolving risk, stay compliant across the board, and make informed decisions that will add value to the business

Orases

Orases – software is designed to offer a holistic approach to managing various financial risks, enabling firms to achieve stability and informed growth.

- Integrated Risk Management Framework

- Predictive Risk Analytics

- Real-Time Risk Monitoring

- Automated Compliance Reporting

- Customizable Dashboards

- Climate Risk Analytics

- Credit Risk Evaluation

- Market Risk Valuation

- Liquidity Risk Management

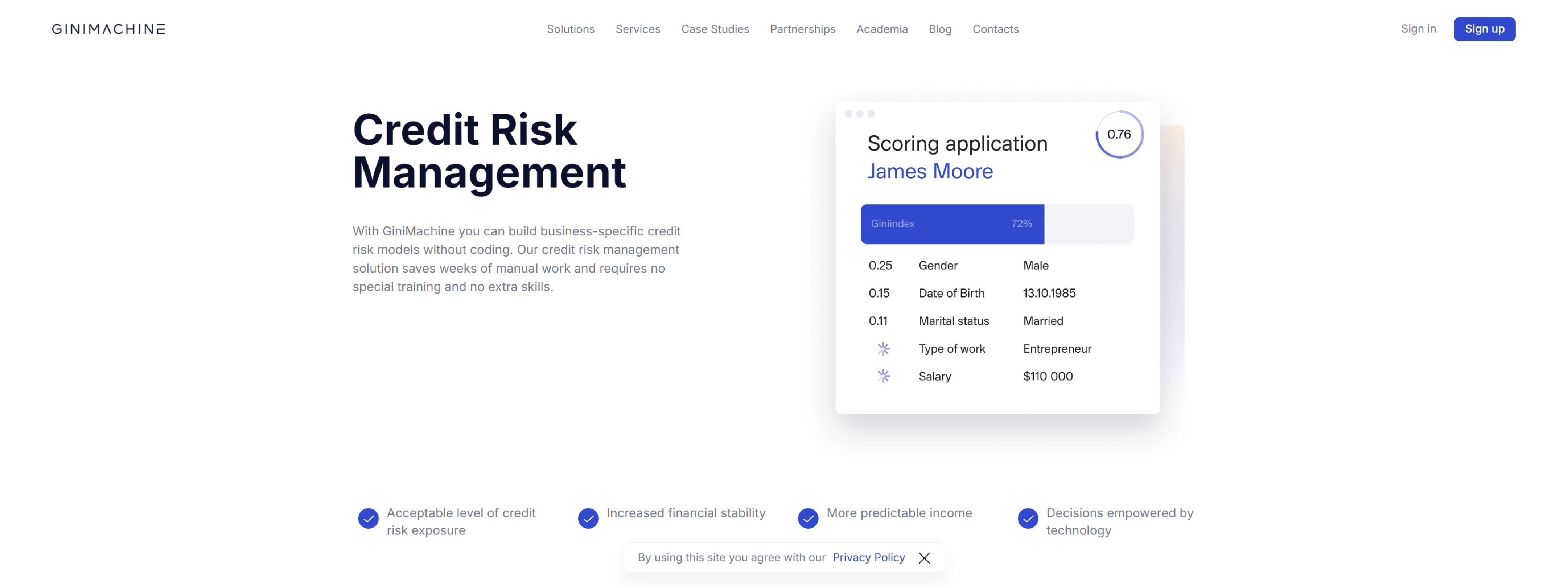

Ginimachine

GiniMachine AI is a full-scale software for credit risk management. Build, validate, and deploy high-performing credit risk models automatically.

- Works with any kind of data, both structured and unstructured. It builds, validates, and deploys models in 2-10 minutes

- Provides proven economic efficiency – fewer NPLs, higher acceptance rate, better performance of a loan portfolio

- Requires no special training, helps to save time, and to reduce labor costs.

Sas

No matter how your financial institution prioritizes enterprise risk management, SAS has proven methodologies and best practices to help you establish a risk-aware culture, optimize capital and liquidity, and meet regulatory demands.

- Improve regulatory compliance and instill powerful balance sheet management capabilities

- Deploy a broad range of scalable credit models to continuously manage your loan portfolios

- Simulate over multiple scenarios. Produce results faster with a richer analysis to inform business decision making

- Execute the entire ECL process in a substantially reduced time frame using a controlled, high-performance environment

- Proactively govern risk management processes to achieve business and regulatory goals

- Adopt a single, integrated framework for IFRS 17 and Solvency II compliance – and beyond

Oxagile

Oxagile – experts in developing financial risk management software, we’ll help you protect your mission-critical data against fraud and avoid costly downtime.

- Accurate sales forecast

- Advanced financial market analysis

- Comprehensive interest rates research

- Extensive investment risk analysis